Analyze with AI

Get AI-powered insights from this Mad Devs article:

Cash is becoming obsolete as the traditional financial system actively adopts modern technologies. In recent years, innovative solutions like Apple and Google Pay, smart contracts, cryptocurrency, and contactless payments have emerged to increase the number of cashless payments. To retain current and attract new customers, brick-and-mortar banks have no choice but to innovate and digitize their services.

While it is common to associate FinTech with only payment systems and digital banking, this sector encompasses all technological innovations in finance, from investments to personal budgets.

This article provides an overview of the digital banking app market and explains why your bank should build a mobile app if it hasn't yet. Then, you'll find a step-by-step guide to developing your own app. For inspiration and more context, a list of popular digital banking startups is included at the end of the article.

A review of the global digital banking market

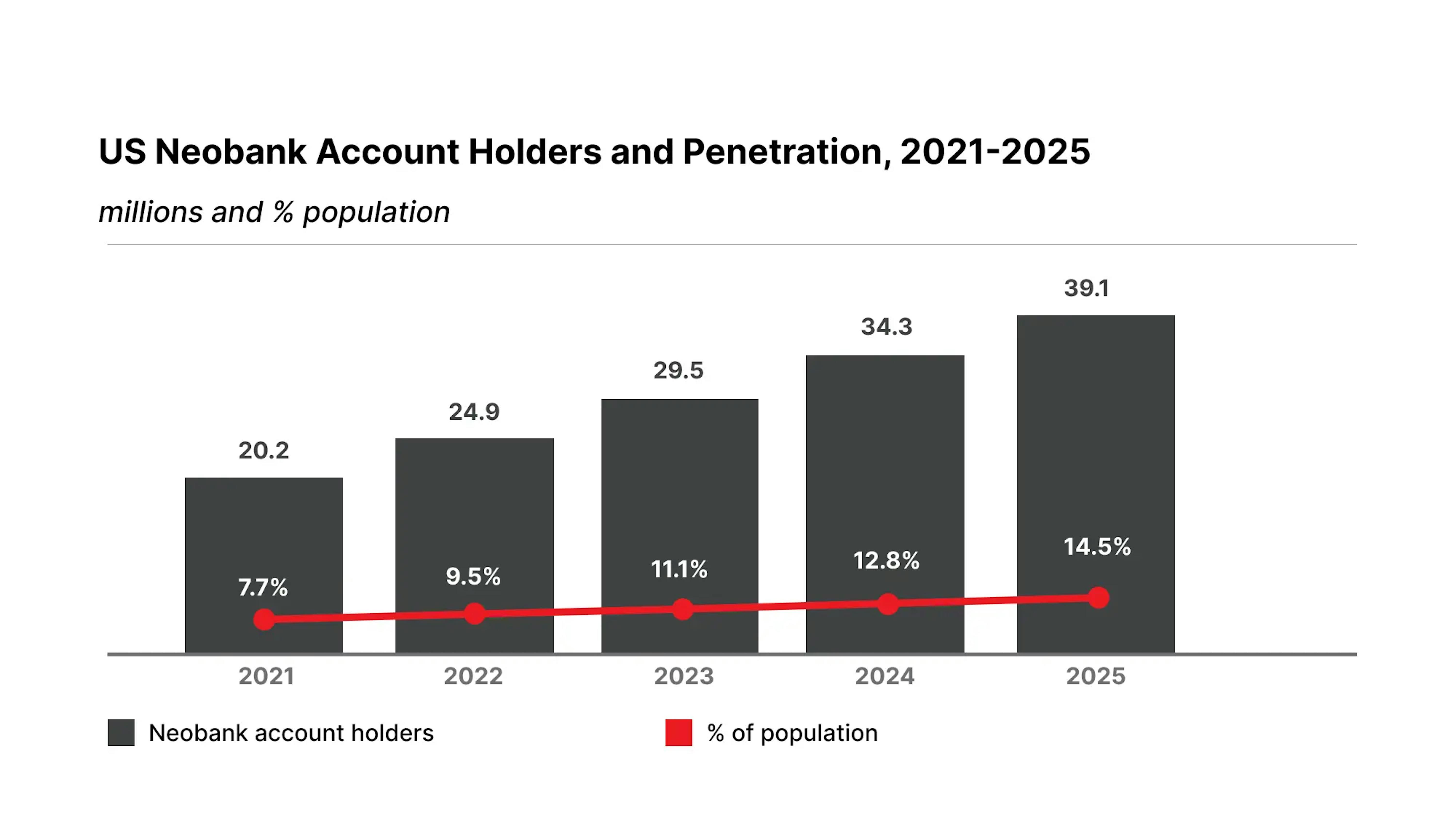

According to Facts and Factors, the size of the Global Digital Banking Market will grow from $7.9 trillion in 2021 to $10.3 trillion by 2028. A Research Dive report says the global digital banking market is expected to generate a revenue of $1,610 billion and grow at a CAGR of 8.9% over the forecast timeframe from 2019 to 2027.

Digital banking has boomed over the last few years. According to the comparison site Finder, to the comparison site Finder, over two-thirds (36%) of British citizens own a digital-only account in 2024

Recent Celent research stated that 75% of financial institutions globally see the threat of FinTech and challengers increasing, while 58% believe it is harder to win and retain customers.

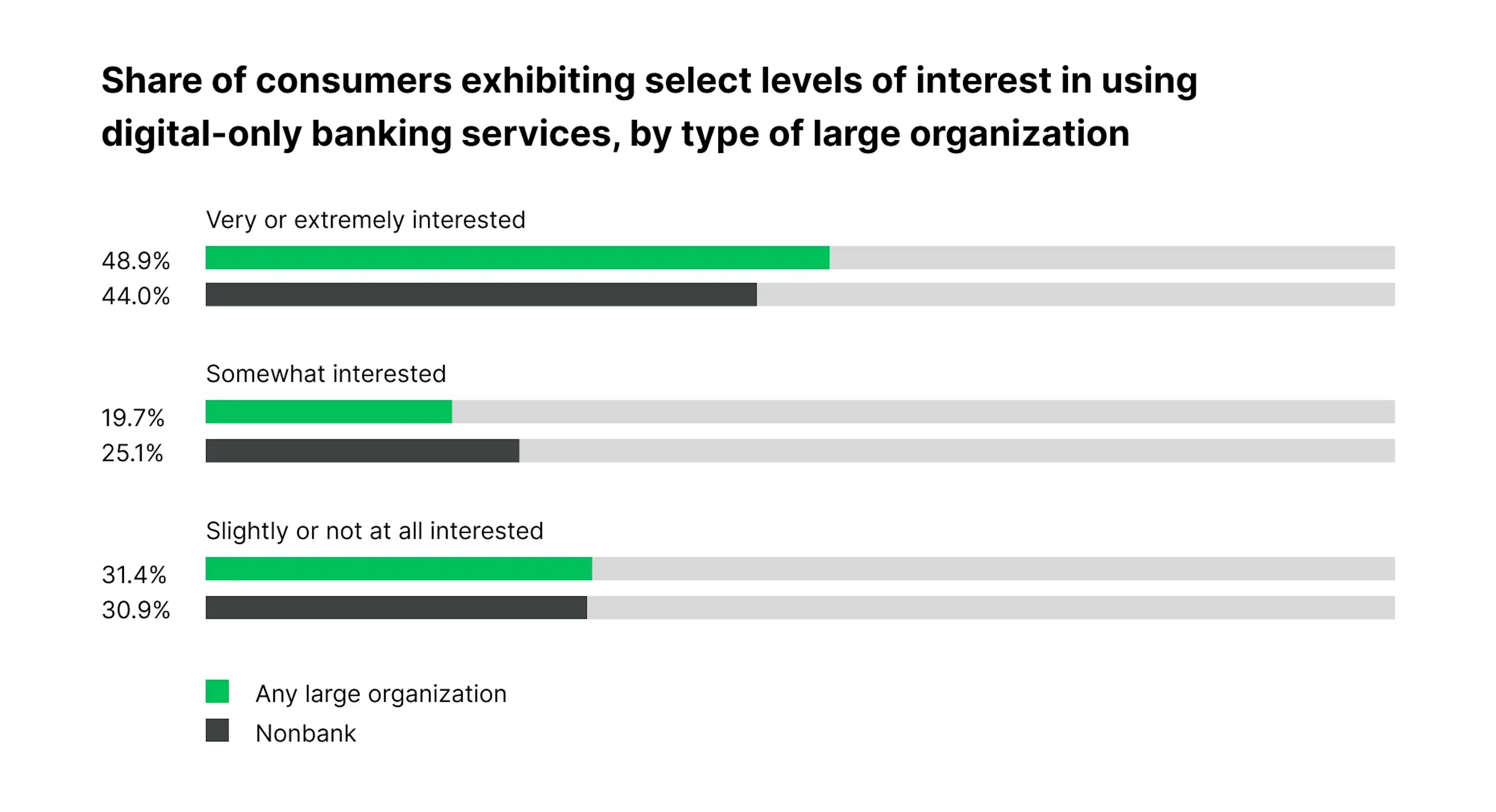

Consumer interest in digital-only banking services for large organizations.

The main factors driving the market's expansion are:

- the rising number of internet users;

- a shift from conventional banking toward online banking;

- increased cloud platform adoption, which allows for more scalability.

Digital banking is expanding, but there are security and compliance issues.

In addition, it is anticipated that artificial intelligence (AI) and machine learning (ML) will find increased use in digital banking, advanced banking services, and corporate investments. In the next few years, innovative technologies are expected to benefit the digital banking market significantly.

For example, many banks and financial institutions offer better customer service through AI-based systems. In addition, many banks implement ML for preventative fraud detection as an enhanced security measure. These and other innovative developments offer the industry various opportunities to improve their products and services.

The expansion of digital banking during the COVID-19 pandemic was particularly notable, which opened room for growth in the digital banking market for newcomers. Many financial institutions are providing their customers with new digital tools to help them overcome the challenges they face in their operations.

Here are other insights from Global Newswire:

- The Digital Banking market will likely grow above a CAGR of around 4.50% between 2022 and 2028.

- The estimated market worth in 2021 was around $7.9 trillion and is expected to hit approximately $10.3 trillion by 2028 as a result of various driving factors.

- One such growth factor is the push by the millennial generation for banks to offer digital services.

Why invest in mobile banking app development?

The market has expanded in tandem with changes in how consumers view their routines following the global pandemic. They interact with stores, restaurants, and even each other differently than before and want their banking to fit into their all-digital lives to work seamlessly and on demand.

Research shows:

- The majority of U.S. users prefer mobile banking, with 90% preference among younger consumers and over 50% among elderly Americans.

- The UK shows 66% preference toward digital banking services, with more than 50% usage among elderly groups and 85% within the 18-24 age group.

- In Canada, 80% of bank customers use mobile apps for operations.

As the data shows, any traditional or neobank looking to develop an app will have no difficulty finding users. Besides acknowledging consumer demand, mobile banking allows financial institutions to offer products and services that a mortar-and-brick bank cannot. Some examples include:

- AI-guided investments to optimize earnings

- Budgeting and analytics for smart money management

- Integrations with other digital services, such as public transport

Besides the convenience offered by digital banking, the mobile banking revolution aligns with the values of many consumers. Now, banking services and financial education are available to more people worldwide, creating a fairer market. Care for the environment is at the core of many digital banking services since less or no paper is involved in transactions.

The question, then, is not why you should consider building a mobile banking app but how to do it.

Developing an online banking application

Whether you represent a financial institution or a FinTech startup, the steps to building a mobile banking app are the same:

- Build a team

- Plan and discover the project

- Prepare security steps

- Design UI/UX

- Develop, test, release, improve

You may find it obvious that the first step is to form a team and maybe you think you already have everyone you need for the project. That's why we've included it as the first and, in our opinion, most essential step. Having the right people on your project is the foundation for creating a product that meets user demand. You need to find experienced software developers who can help with research, planning, documentation, and other critical tasks. If you are looking for such a team, fill out the form to put Mad Devs' expertise to work for you.

1. Build a project team

Your mobile banking application development team requires, but not be limited to:

- Back-end developer(s);

- Mobile developers to implement the client-side;

- UX/UI designer;

- Quality assurance (QA) engineers;

- Project manager (PM) or Scrum Master.

This is not an exhaustive list, and more specialists may be needed depending on your app's features.

Feel free to skip this section if you have a cross-functional in-house team ready to develop your banking app now. Otherwise, you'll have to hire the necessary experts from within the local market or through outstaffing and outsourcing.

Outsourcing your project is a safer and more cost-effective option than hiring freelancers since such companies have a track record of successfully developing mobile banking products, effective workflows, and NDAs to protect your intellectual property. Additionally, they have mechanisms to meet your budget and requirements. Those responsible for building your app must understand the digital banking environment and the regulations and standards they may have to follow, such as GDPR, PCI DSS, PSD2, ISO/IEC 27001, etc.

Mad Devs can offer you a dedicated team to bring your digital banking app to life. Learn more about Mad Devs' Fintech portfolio and see how we bring value to our customers and end users.

As well as advising you, your banking app developers should select the most appropriate technologies for your project. They may also suggest integrating third-party services, a suitable payment processor for easy payments through the app, etc., for an easier development process and shorter time-to-market.

Technology stack for iOS and Andriod native apps

Swift

Apple Xcode

iOS SDK

Kotlin

Android SDK

Android Developer Tools

Technology stack for hybrid and cross-platform apps

Java Script

HTML5

CSS

TypeScript

Dart

C

Ionic

React

Flutter

Xamarin

Apache Cordova

Technology stack for backend development

PHP

Python

Ruby

Node JS

Java

Laravel

Cake PHP

Ruby on Rails

Django

Flask

Express JS

Spring Boot

2. Plan and discover the project

If you have an existing online banking service, you may be tempted to replicate it on mobile devices or copy a competitor's product. However, mobile banking solutions that follow these approaches are risky.

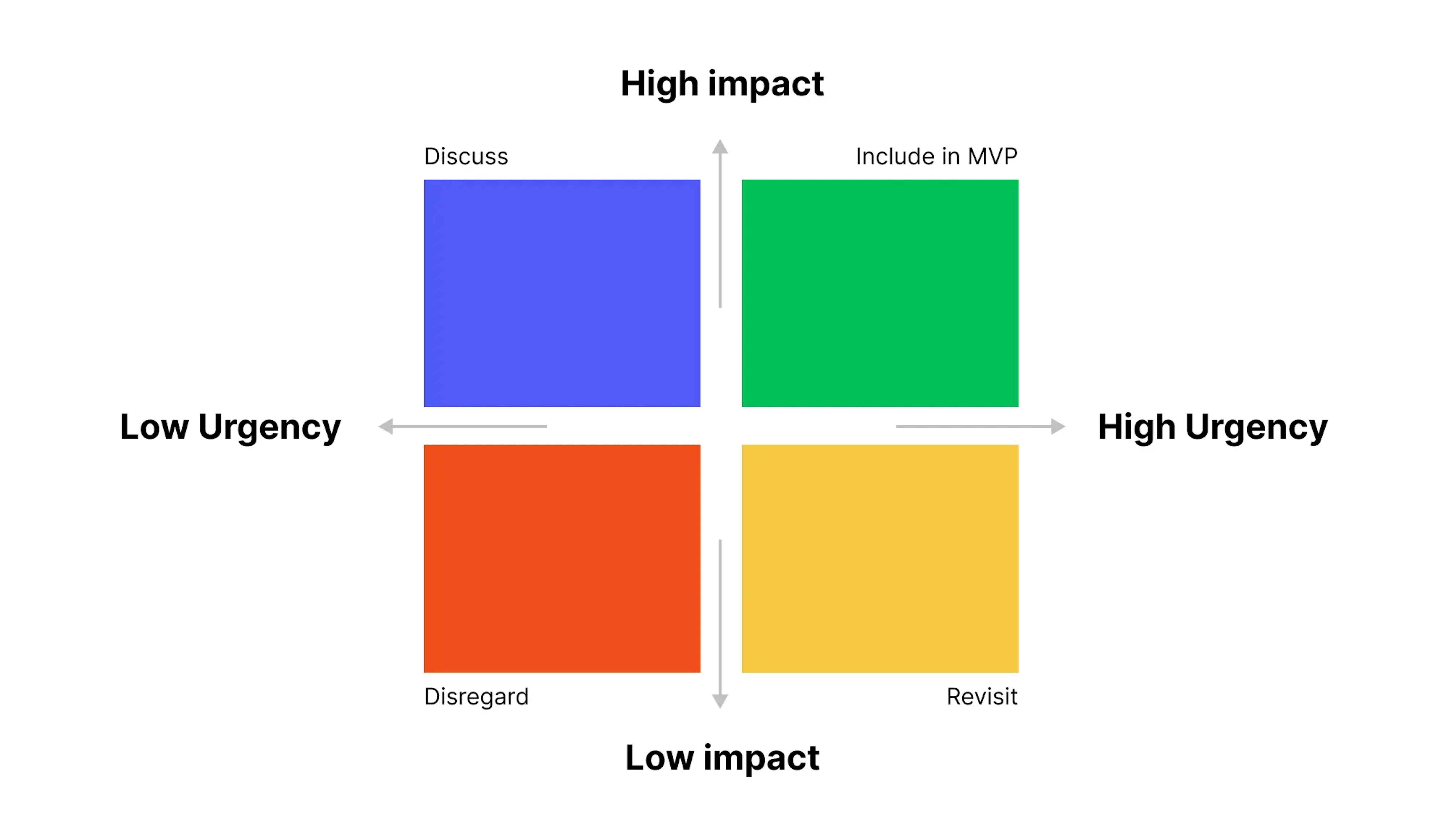

Instead of a lengthy and expensive initial development, limit the first version of your app to the minimum number of features that meet a use's primary needs. This is called a minimum viable product or MVP.

The discovery stage includes discovering ways to make the product competitive, prioritizing features, documenting requirements, and even designing the first interface.

Customers only expect to perform a few habitual tasks on the go and can wait for a gradual expansion of the app's functionality. Analyze the interactions of existing users with the mobile app on their devices to discover the most popular features.

Also, explore the best-rated and most popular banking apps in your region through Apple's App Store and Google Play. Analyze the quality of the product, make a list of necessary features, and think about how to improve your product. To impress their first users and set the app apart from the competition, startups might need to include 1-2 innovative features in the MVP. Later, the company can modify these features and add new capabilities based on user feedback.

To create a successful banking app, study the following:

- Needs, main pain points, preferences, lifestyle, age, and other factors of your target audience

- Weaknesses and strengths of your competitors

- Current mobile banking and FinTech trends

In addition to these points, startups need to determine the profitability of a particular market and the target audience's level of interest in a new mobile banking product. Test the end-user prototype with actual end users through market research, surveys, and interviews.

Hiring experienced banking application developers like Mad Devs in the early stages helps you:

- Identify your target audience and future segment end-users

- Professionally analyze competitors' offerings

- Document and visualize the optimal feature set with user flows, diagrams, and wireframes

- Select your preferred platform and approach: native, hybrid, or cross-platform

- Implement everything with the right tech stack

📖 Learn more about the mechanism of project estimation and how Mad Devs finalizes price estimations and evaluations for software development projects. Mad Devs' Software Development Cost Estimation

3. Prepare security steps

Mobile banking app development is challenging because of multiple privacy and safety concerns. Apps must meet financial industry regulations and KYC (Know Your Customer) standards to protect sensitive customer data and finances, and this is a top priority for app developers from the beginning of the development process.

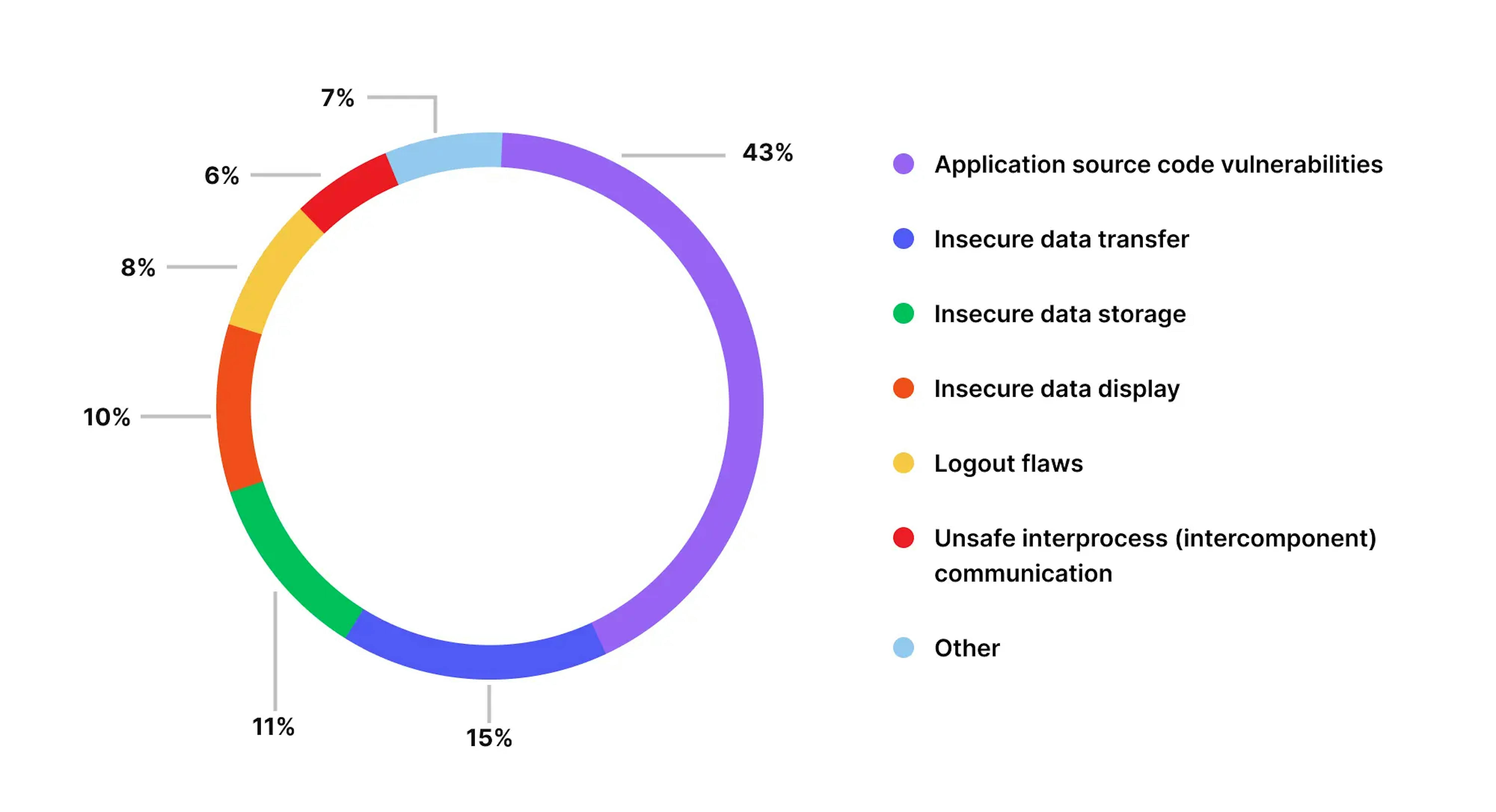

Positive Technologies identifies the following vulnerabilities and threats facing digital banking:

- In 13 out of 14 audited applications, attackers could access user data from the client side

- iOS apps contained fewer vulnerabilities than their Android counterparts

- 76% of vulnerabilities can be exploited without device manipulation

Your developers can integrate several security solutions into your app to secure user data:

- Multi-factor authentication

- Transaction verification through push notifications

- Digital signatures for secure transactions

- Inactivity timers

- Blurred screens when users switch between apps

- Automatic blocking of suspicious payments

- Dynamic CVC2; a three-digit code that changes daily or even hourly

- App's passwords and transaction-related information can't be stored on mobile devices

- Downloaded or received data is erased when app is deleted

- High-level encryption of app software and card storage to prevent other devices from accessing app data

- Protection against repackaging*

- In-app educational content on privacy, credentials, and sensitive information storage

*when a hacker obtains a copy of the app, unpacks it, adds malicious functionality, and then repacks it to use

Take time at the beginning of development to choose the measures you will take to secure your users' privacy and data. Delaying this step and implementing changes later in the process will delay development and release.

4. UI/UX design and prototyping

At this stage, you need someone with experience in mobile UX/UI design. Cognitive and cultural considerations are equally important to the specification and iOS/Android material design guidelines.

The designer's process involves:

- Creating UI wireframes. They are improved iteratively until high-fidelity mockups of the main screens have been created.

- Developing a style guide. If a bank already has a web application, they will likely use the bank's existing logo and color themes. This is the stage when startups create a unique brand and give an app a visual identity.

- Creating a prototype that is given to programmers once approved.

The typeface, colors, other visual elements, and even the 'voice' of your in-app messages should appeal to your target audience.

5. Develop, test, release, improve

This is the stage where the design comes to life. Programmers develop both the interface and the backend of the app. Due to the app's inability to process transactions itself, the developers connect the app with the bank's server.

They will likely integrate several APIs (application programming interfaces) to enable data exchange between different apps. These integrations' benefits are visualization of bank data, cross-bank money transfers, expense tracking, and electronic signatures.

Firebase, CloudKit, and AWS Mobile Hub are off-the-shelf solutions.

QA engineers ensure that the products comply with the specifications and all applicable FinTech industry standards as part of the development process. You should test your MVP or full-scale product at the end of every sprint or after each feature delivery.

It is the tester's responsibility to find all functionality and code errors and vulnerabilities. Small, controlled groups of users can then access the product after its final approval. In addition to their feedback and analytics, stress-testing the servers will increase your chances of success.

The following briefly explains a mobile banking application development process until publication. Monitor your system, fix bugs, perform maintenance, update after OS updates, improve, experiment, do UX/UI audits, etc.

Popular mobile banking startups

Here are some interesting mobile banking startups to inspire your mobile banking app. Each has embraced the possibilities offered by digital banking to align with consumer desires and find a niche that matches their values, whether it's region-specific or related to the green economy.

Kuda

|

| |

| Native name | Kuda Microfinance Bank |

| Founded | 2016 |

| Founders | Babs Ogundeyi, Musty Mustapha |

| Plarform | Android, iOS |

| Headquarters | London, England, UK |

| Operating | Nigeria |

| Website | kuda.com |

Kuda Microfinance Bank, or just Kuda Bank, is a fully licensed bank in Nigeria available to residents and citizens of the country who want to transition from traditional banking to convenient, digital banking. The Lagos-based company has earned the trust of over 1.4 million clients, and its mobile app is now considered one of the best finance platforms available on the Nigerian market.

Key features:

- Free debit cards

- Free withdrawals at over 3,000 ATMs across Nigeria

- Users can earn up to 15% interest on their savings

- No paperwork

- Automatic budgeting tools for money management

- Users can categorize and track their spending habits

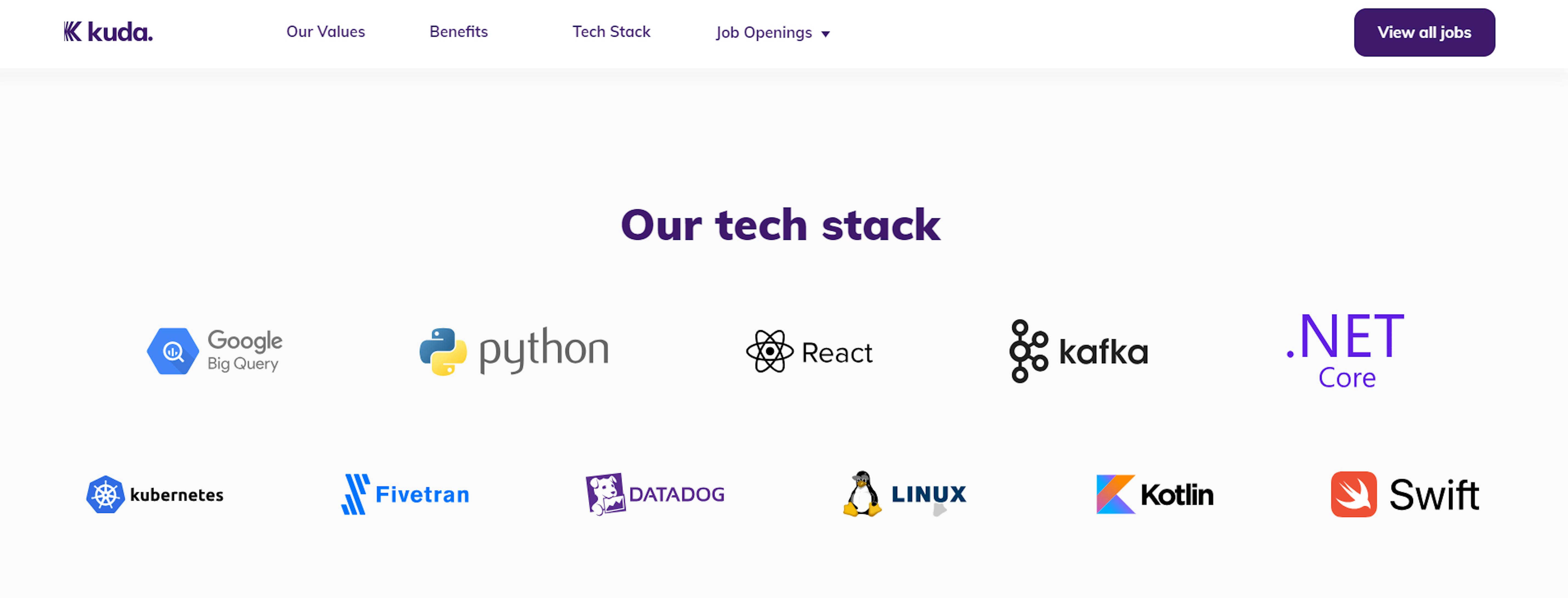

⚙️ Tech stack

Starling Bank

|

| |

| Native Name | Starling Bank |

| Founded | 2014 |

| Founder | Anne Boden |

| Plarform | Android, iOS |

| Headquarters | London, England, UK |

| Operating | Users can currently send international payments to 36 countries |

| Website | starlingbank.com |

Starling was the first digital bank account to join the Current Account Switching Service, making it possible to change banks. As soon as Starling launched, it set out to innovate. It was the first mobile app to enable Apple Pay in the UK.

Key features:

- Interest on current accounts

- Fee-free spending abroad

- No monthly fee

- Desktop version

- Virtual cards

- Saving spaces

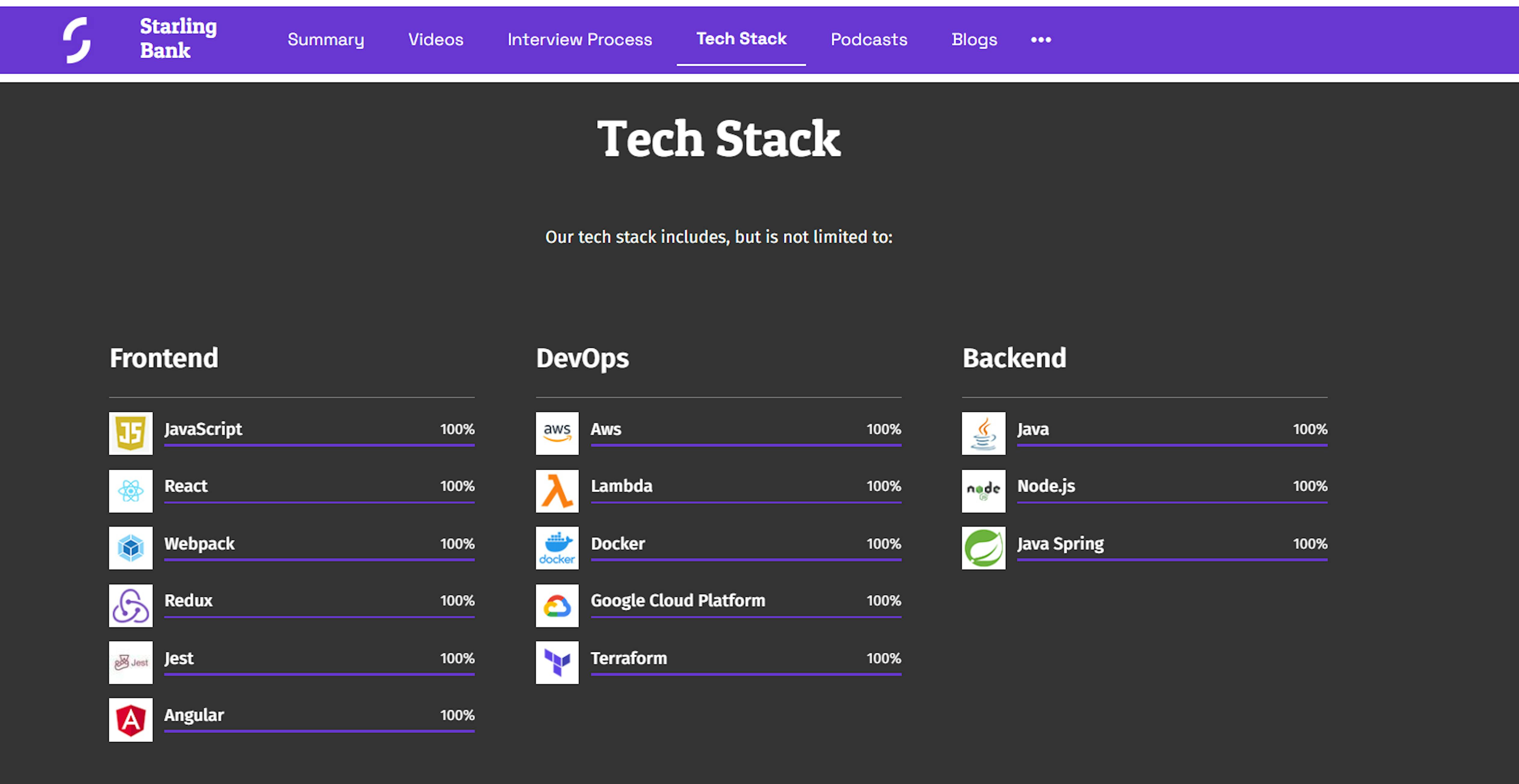

⚙️ Tech stack

Tandem Bank

|

| |

| Native Name | Tandem Money Limited |

| Founded | 2015 |

| Founders | Ricky Knox, Matt Cooper, and Michael Kent |

| Plarform | Android, iOS |

| Headquarters | London, England, UK |

| Operating | UK |

| Website | tandem.co.uk |

Tandem Bank, founded in 2013 by Ricky Knox, Matt Cooper, and Michael Kent, is owned by Tandem Money. In 2018, Tandem acquired Harrods Bank, giving it full bank status and a banking license.

Tandem is unique in its commitment to improving and supporting the Earth's environment. Their entire mission is to help their users choose greener lifestyles.

Key features:

- Free and easy to use

- Committed to financing green initiatives

- Lending money to help users make greener choices

- FSCS protected

⚙️ Tech stack

Application and data

Airflow

Amazon Aurora

Amazon Elastic MapReduce

Java Script

TypeScript

React Native

Swift

Kotlin

C

Python

Spark

MongoDB

Apache Hive

Business tools and utilities

Elasticsearch

Amazon Kinesis

Gatsby Cloud

Slack

Jira

Confuence

Figma

DevOps tools

Docker

Jenkins

New Relic

Amazon EC2 Container Service

AWS CloudFormation

Kong

Apache Aurora

Jest

Chime Bank

|

| |

| Native Name | Chime Bank |

| Founded | 2014 |

| Founders | Chris Britt, Ryan King |

| Plarform | Android, iOS |

| Headquarters | San Francisco, California, United States |

| Operating | Users can use a Chime bank card anywhere Visa is accepted, but it won't be able to use in blocked countries |

| Website | chime.com |

Chime, based in San Francisco, is a financial services software company. It operates similarly to a fee-free online bank.

With Chime, users can open a checking or savings account online and deposit money into their accounts with two banks. The FDIC still ensures banks' accounts so users can keep their money there safely. There are no monthly or overdraft fees with Chime, and users can round up purchases to the nearest dollar and save the remainder. Since it doesn't have a bank charter, it can be expensive to deposit cash.

Chime made its public debut on the Dr. Phil show in 2014. The company has raised about $2.3 billion and was valued at $24.3 billion in its Series G round in August 2021.

"Nobody wants to go into bank branches, nobody wants to touch cash anymore, and people are increasingly comfortable living their lives through their phones," Chime CEO Chris Britt told CNBC in September 2020.

Key features:

- No monthly fees

- Fee-free overdraft up to $200

- In-app transfers to other banks

- Direct deposit for early paychecks

⚙️ Tech stack

Application and data

React

TypeScript

ES6

Amazon S3

Amazon EC2

React Native

Ruby

Rails

Golang

Amazon RDS

Elixir

Snowflake

Amazon Aurora

Amazon Athena

AWS Glue

Citus

GraphQL JS

Business tools and utilities

Google Analytics

Twilio

Optimizely

Segment

Looker

Plaid

Slack

G Suite

Zendesk

DevOps tools

GitHub

Kubernetes

Visual Studio

Vim

Atom

CircleCI

Datadog

Rollbar

Emacs

Helm

Consul

PagerDuty

Vault

Code Climate

Spinnaker

Tilt

Monzo

|

| |

| Native Name | Monzo |

| Founded | 2015 |

| Founders | Gary Dolman, Jason Bates, Jonas Huckestein, Paul Rippon, Tom Blomfield |

| Plarform | Android, iOS |

| Headquarters | London, England, UK |

| Operating | Monzo card should work anywhere that accepts Mastercard. |

| Website | monzo.com |

Monzo was founded in 2015 and has since become one of the most popular digital banks in the UK.

All five founders, including Tom Blomfield, Jonas Huckestein, Jason Bates, Paul Rippon, and Gary Dolman, previously worked at rival Starling Bank. Has over nine million customers worldwide. In 2018, a £20 million crowdfunding campaign raised a record £1m in 90 seconds.

Key features:

- Different monthly plans, including a free option

- Fee-free spending abroad

- Overdraft and loan management

- Support for users with financial difficulties

⚙️ Tech stack

Application and data

Python

Node JS

React

Java

NGINX

CloudFlare

Google Drive

Amazon S3

Amazon EC2

Kafka

Golang

Scala

Cassandra

Google BigQuery

Business tools and utilities

Stripe

Amazon Route 53

Mailgun

Optimizely

AWS Direct Connect

Slack

Jira

G Suite

DevOps tools

GitHub

Kubernetes

Git

Docker

Sentry

Vagrant

etcd

Linkerd

Time to start

Developing a mobile banking app is a challenge but the growing market promises rewards to those who approach the process with correct expectations and an understanding of how to create a strong product that users will love. Mad Devs has extensive experience developing mobile banking applications, from software development to the various legal, marketing, and security issues involved in the process.

Contact us today to begin building your digital banking app from scratch.